What Classes of companies are required to comply with ICFR?

The classes of companies that are required to comply with the ICFR requirements vary based on the specific regulation. The ICFR requirements for the Investment and Securities Act (ISA) 2007 affect all public listed companies (PLC) in the Nigeria Stock Exchange Market (now NGX Group).

CAMA 2020 ICFR compliance affects all companies having shares and registered with CAC. Companies considered as small by CAMA 2020 are exempted.

The ICFR requirements by Financial Reporting Act 2011 affect the companies classified as Public Interest Entities (PIE).

Small companies and nonprofit organizations are generally not required to comply with the ICFR in Nigeria but will benefit from the ICFR rewards to strengthen the organization’s ability to wither stormy weathers, maintain good credit ratings and reputation.

The FCR ACT 2011 exempts these companies from the ICFR compliance requirements:

(i) Small companies as defined by CAMA 2020.

(ii)Micro Finance banks (as defined by Central Bank of Nigeria),

(iii) Insurance Brokers,

(iv) Non-Tertiary Educational Institution,

(v) Non-Tertiary Health Institution,

(vi) Any other as may be considered by FRC from time to time.

The Financial Reporting Council of Nigeria (FRC) through its “Guidance on Management Report on Internal Control Over Financial Reporting” states that any Public Listed Companies listed in the Nigerian Stock Exchange Market (now NGX Group) that apply the SEC Guidance on Management Report on Internal Control over the Financial reporting need not apply the FRC guidance and shall be assumed to have complied with ICFR sections 7(1 and 2f) of the FRC Act of 2011.

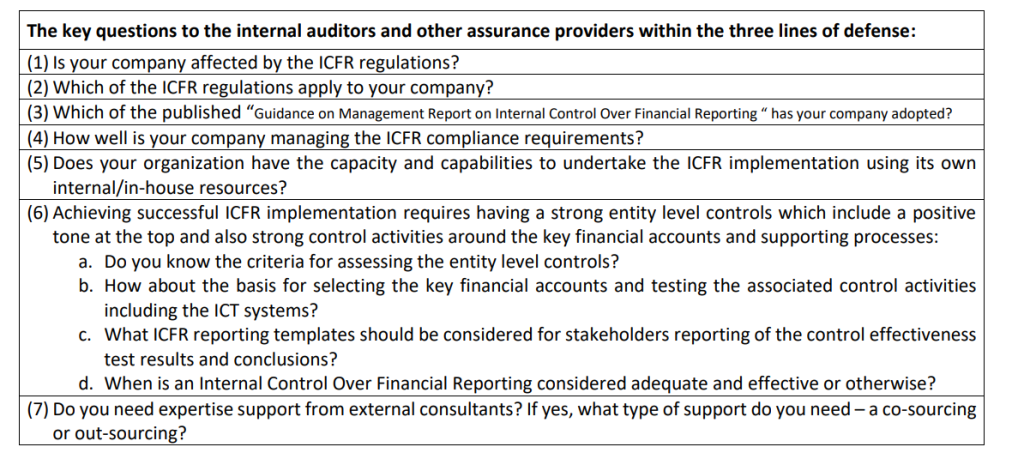

The key questions to the assurance providers are:

Achieving the above certification and attestation requirements could be herculean tasks for the regulated companies and their statutory auditors. The implication is that the approving officers, signing officers and certification officers of the audited financial statements should trust the competencies and capabilities within their business functions and three lines of defense assurance providers. The trust will strengthen their confidence to believe that the financial accounting treatments, record keeping practices and reporting processes fully conform to the applicable accounting standards which in this case is IFRS In Nigeria.

Given that the compliance requirements for internal control over financial reporting is focused on the financial controls around the financial transactions processing and reporting processes, it is very important to note that adopting a big picture approach in the ICFR implementation by embedding a robust Agile Risk Based Enterprise Risk Management (ERM) Framework For assessing risk exposures, developing risk responses and adopting strong Combined Assurance Strategy for testing control activities enterprise wide provide a great advantage to the organizations in making the certification requirements on the credibility of their financial statements.

Thank you for this insightful post. And thanks for creating awareness as some companies are not even aware of the the immense benefits of ICFR

Thank you for free lecture.

Great write up…simply explained.