The Combined Assurance Situation In Nigeria

Combined Assurance Model is still at the embryo stage in Nigeria. The topic appears to be gradually emerging.

At the moment, there is no explicit laws and regulations on combined assurance model in Nigeria. However, the current legal and regulatory compliance requirements mandating company boards and officers signing audited financial statements in Nigeria to certify the effectiveness of their risk management and internal control frameworks as part of Thei annual audited financial statement reporting is an urgent call for action for organizations in Nigeria to consider the subject as a top agenda on the management, board and board committee meetings.

Presented below are the overview of the laws and regulations in Nigeria driving the need for combined assurance model:

- Investment and Securities Act (ISA) 2007, sections 60 and 61 (60 refers to Filing of annual and periodic reports with the Commission) while 61 refers to System of internal control of public companies)

- Company and Allied Matters Act (CAMA) 2020 section 405. The section refers to Corporate Responsibility for Financial Report).

- National Code of Corporate Governance (NCCG) 2018, Principle 11 section 11.4.7.3. The principle refers to the statement “to ensure efficiency and effectiveness, the Board delegates some of its functions, duties and responsibilities to well-structured committees, without abdicating its responsibilities”.

Provided below are some excerpts from the relevant sections of the above laws and regulations:

Excerpts from the Investment and Securities Act (ISA) 2007, section 61

- 1). A public company shall establish a system of internal controls over its financial reporting and security of its assets, and it shall be the responsibility of the board of directors to ensure the integrity of the company’s financial controls and reporting.

- 2). The board of directors of a public company shall report on the effectiveness of the company’s internal control system in its annual report.

Excerpts from Corporate Affairs and Allied Matters (CAMA) 2020 – section 405

- (1) The chief executive officer and chief financial officer of a company other than a small company or persons performing similar functions shall certify in each audited financial statement that the:

- (b) officer who signed the audited financial statements

- (ii) has evaluated the effectiveness of the company’s internal controls within 90 days prior to the date of its audited financial statements, and

- (iii) certifies that the company’s internal controls are effective as of that date ;

- (2) Where a managing director, chief financial officer or person performing similar functions fails to discharge the duty imposed on him under this section, he commits an offence and is liable on conviction to a penalty as the Commission shall specify in its regulations

Excerpts from Nigeria Code For Corporate Governance (NCCG) 2018 – Principle 11

There are many sections relating to internal control in the NCCG 2018 code and these include principles 11, 17 and 18, but principle 11 section 11.4.7.3 is specific on the annual certifications to Financial Reporting Council of Nigeria (FRCN) in the audited financial statement report. Principle 11, section 11.4.7.3 states that the Board audit committee ensures the following:

- development of a comprehensive internal control framework for the company,

- obtain appropriate (internal and/or external) assurance and report annually in the company’s audited financial report on the design and operating effectiveness of the company’s internal controls over the financial reporting systems.

For more details about the compliance requirements for internal control and risk management responsibilities of the board and signing officers of the audited financial statement, please refer to the websites of the relevant regulators – Nigerian Exchange Group (NGX, formerly Nigerian Securities and Exchange Commission -SEC). Cooperate Affairs Commission (CAC) and Financial Reporting Council Of Nigeria (FRC).

Very insightful!

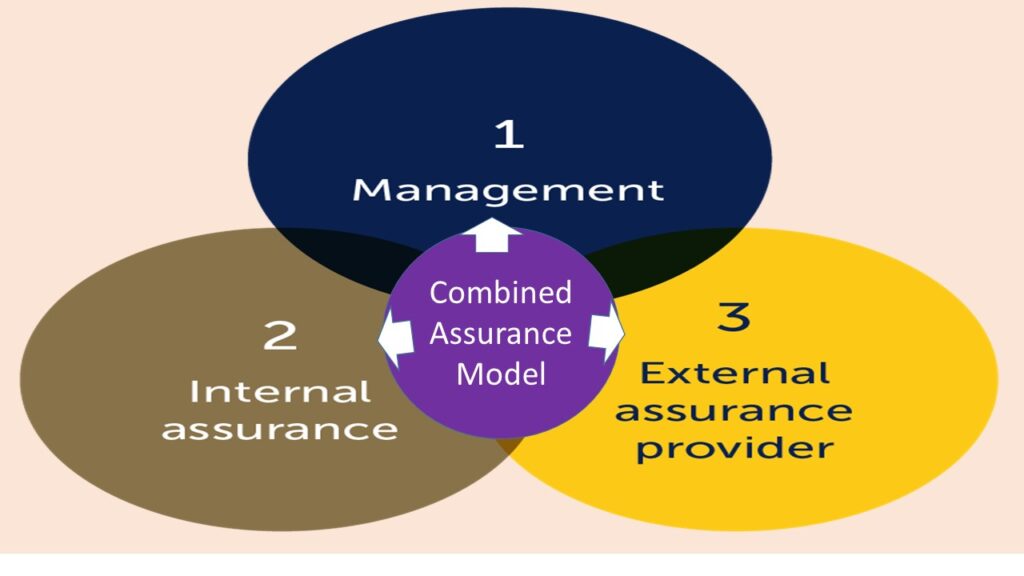

A Combined Assurance Model (CAM, if properly deployed will eliminate waste of resources, optimise assurance cost and ultimately a plus to the bottom line!