Bottom up Approach – Finding and Predicting Risk

The Bottom-up approach is focused on the departmental and business process level risk events only. It starts by interviewing the head of the business department and reviewing operational level documents such as the annual budget for the department, standard operating procedure manuals, departmental charters and job descriptions, management reports and audited financial statements. The template used for finding and predicting process level risks using bottom-up approach are similar to the template for finding and predicting strategic risks using top-down approach. The only difference is that while the strategic levels and top-down approach considers the company’s purpose and strategic directions, the process level and bottom up approach considers only the purpose of the business department and processes. .

Merits and Demerits of Topdown, Bottom-up models

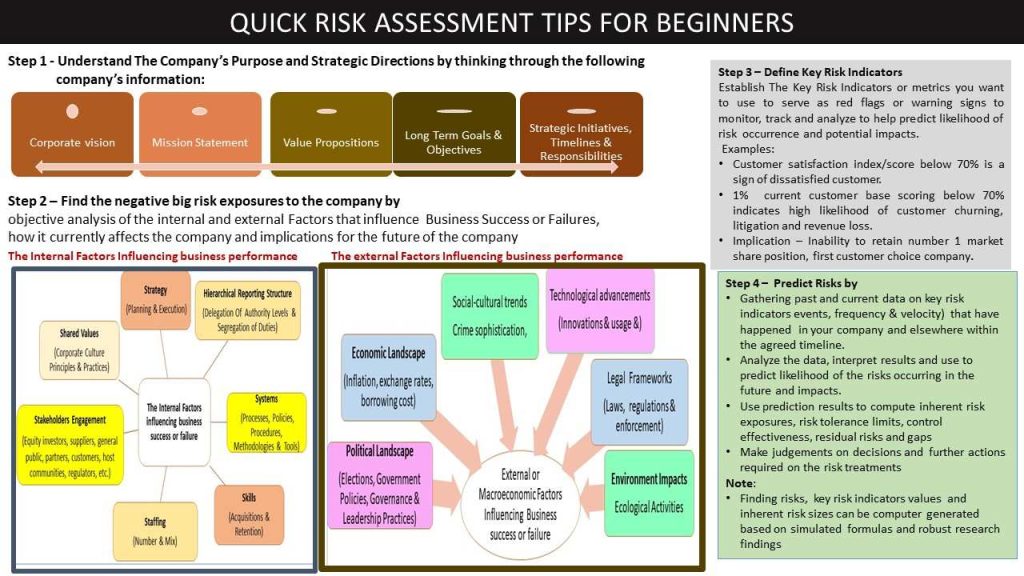

The Top-down approach has significant advantages over the bottom-up approach. The top-down model focuses on the big picture and key things that keep the board and executive management awake at night thereby making it possible to link the risk predictions and risk exposure computation results and management efforts to the real needs of the company.

Bottom-up focuses on the lower-level issues primarily at the departmental and process levels, making it difficult to cascade the process level risks upwards to the big issues and strategic direction of the company.

Top-down approach is more time consuming than the bottom-up approach because of the rigorous level of physical and critical thinking efforts, time and resources involved in information gathering, analysis, data interoperations, results interpretation, report drafting, stakeholders’ presentations, and development of strategic initiatives and implementation plans to effectively deal with the top-level risk exposures.

Conclusion

Quantum Artificial Intelligence is a business partnership productivity tool to enhance business performance and empower risk assurance professionals within the three lines of defense with more capabilities and intelligence to own their jobs and deliver business excellence.

Knowledge of the company purpose, strategic directions and how to leverage strategic business analysis tools and Key risk indicators and the practical applications in real life situations are essential to finding real business risk events, prediction of the likelihood of risk occurrence and severity of impact, computation of the risk exposures and other parameters required to make important decisions towards effective risk management and business performance excellence.

Thanks for investing your time to read my write-up.

Please drop your comment or thumb sign.

To access my other posts, click https://sallyogwookeyumahi.com//blog/

Please, let us know if you need consulting services, practical training and coaching on corporate governance, risk management, internal control, regulatory compliance and internal audit.