Frauds and Revenue Leakages Are Operational Risks.

Revenue is an income made by an organisation from conduct of business operations, Revenue leakage is the loss of revenue caused by intentional or unintentional acts that often start small, unnoticed and gradually build up to a large quantity significant enough to have serious negative impact on the profit margin or bottom line of a business. Frauds risk and abuse are some of the major contributors to revenue leakages in most organisations.

It is important to know that fraud and abuse mean different things.

Fraud is legally defined as the intentional wrongful act done forcefully or by trickery to deprive the victim of valuables or legal rights or cause the victim to take wrong decisions. Abuse is the improper use of an asset contrary to the rules of how it should be used.

Victims of fraud and abuse can be individuals or corporate entity. Fraud and abuse targeted at corporate organisations is generally known as white collar crimes or occupational frauds and abuses while those targeted at individuals are called non-occupational fraud and abuse.

The focus of this blog post is on “occupational fraud and abuses in startup hotel businesses, how they are committed, what to do to minimise the occurrence and the key signs to look for when searching for frauds and abuses any where..

Some Key Facts About Frauds and Abuses.

Below are some key facts revealed by the Association of Certified Fraud Examiners (ACFE, founded in USA in 1988) through the series of global surveys conducted over several years:

- frauds and abuses are in every business, therefore, are part of the unavoidable cost of running business.

- Fraud is destructive to both the victim and perpetrator. The victim losses assets while the perpetrator gets punished if got and proven guilty.

- the clandestine nature of fraud and abuse makes it difficult to completely prevent fraud and abuse 100% from happening in the organisations,

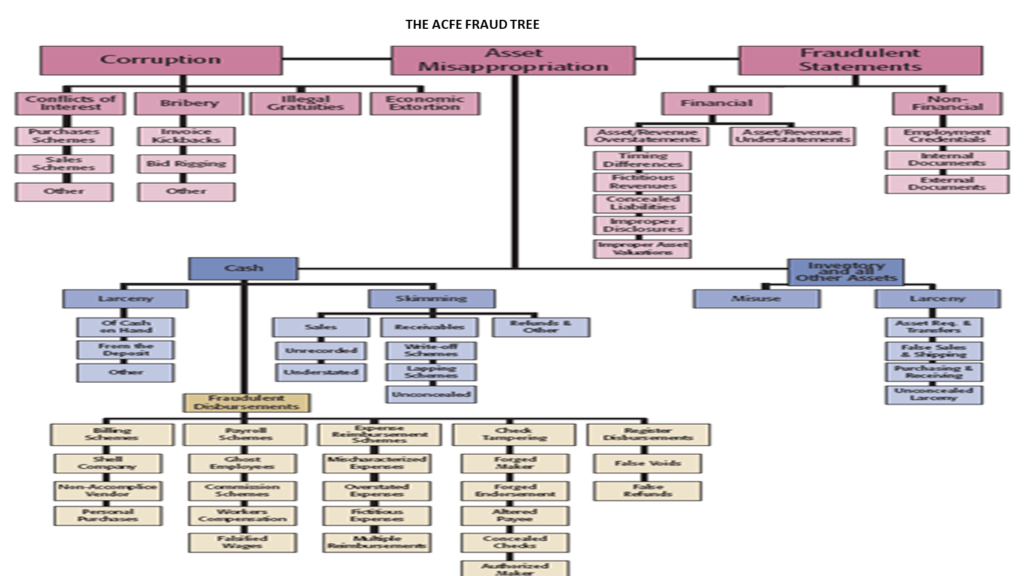

- about 44 fraud and abuse schemes (popularly known as The ACFE Fraud Tree, classified under three categories namely: asset misappropriation, misstatement of financial statement reporting, bribery and corruption can happen in the organisation. See diagram below for example of ACFE fraud tree highlighting the three categories and 44 schemes,

- Out of the three fraud categories and 44 fraud schemes, asset misappropriate which primary comprises theft and misuse of cash, inventory, sensitive information and physical assets are the most frequent. This could be Up to 86% pf the fraud and abuse cases that happen in the organisations.

- The size of destruction caused by misappropriate of asset (i.e., theft and misuse of cash, inventory, information and physical assets,) is often much less than that caused by misstatement of financial statement reporting, and bribery and corruption.

This is engaging and full option.

It qualifies to be a fraud body of knowledge .

Many thanks for sharing.

Very insightful write up Sally. I can relate very well with the content both from the Risk and Hospitality perspective. Keep up the good work.

Very insightful write up Sally. I can relate very well with the content both from the Risk and Hospitality perspective. Keep up the good work.

Very detailed and insightful report. A valuable read for any entrepreneur!

This is quite insightful regarding the key risks the hospitality industry faces on a daily basis. Being able to address the highlighted questions will help business leaders identify and address the leakages that may be affecting profitability.

Once again, thank you for sharing your valuable knowledge with the public as a gift.